Starting with Foreclosure buying tips for first-time investors, the discussion unfolds with valuable insights and practical advice tailored for those entering the real estate market for the first time.

Exploring the nuances of buying foreclosed properties, this guide aims to equip new investors with the knowledge needed to make informed decisions and navigate the complexities of this sector.

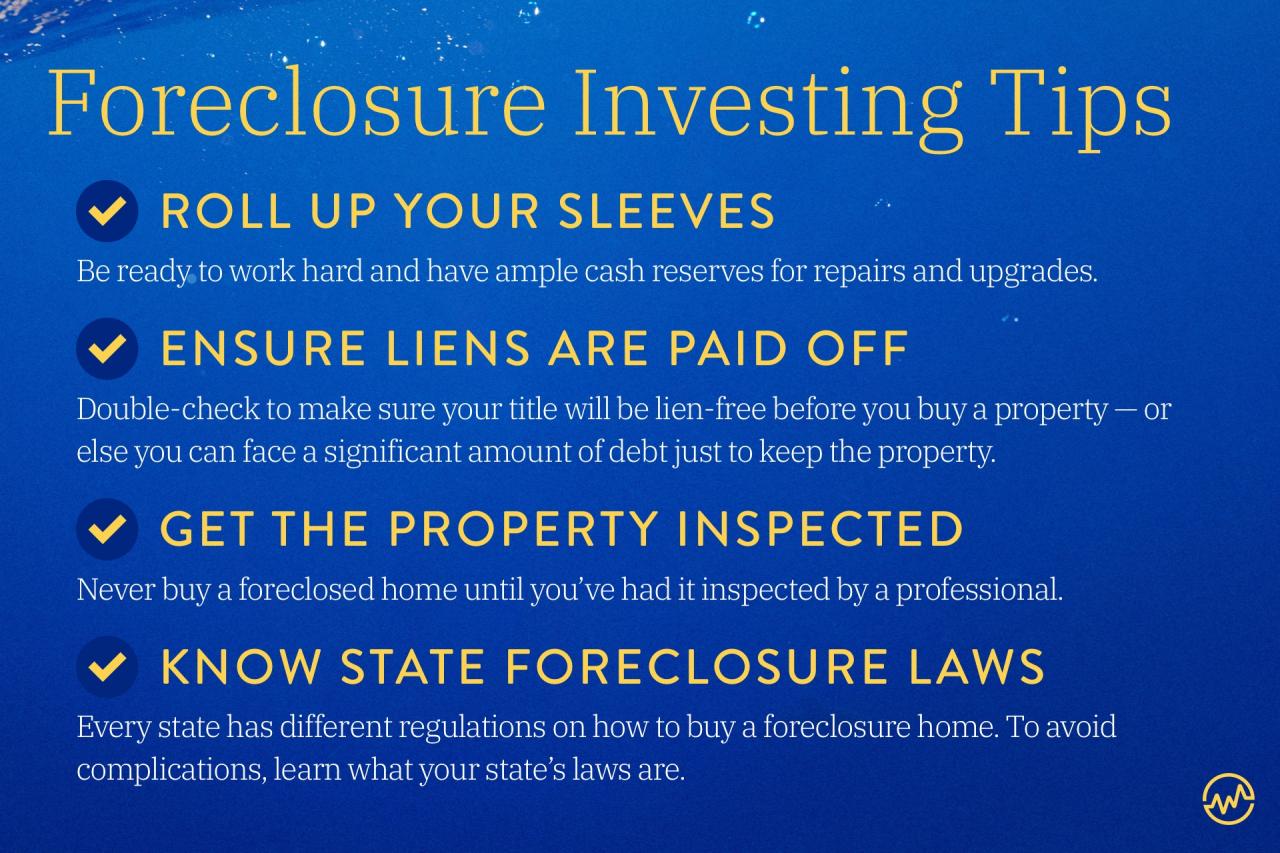

Foreclosure Buying Tips for First-Time Investors

Foreclosures in real estate investing refer to properties that have been repossessed by the lender due to the owner’s inability to make mortgage payments. These properties are typically sold at a discounted price, making them attractive investment opportunities.

Advantages of Buying Foreclosed Properties for First-Time Investors

- Lower purchase price compared to market value.

- Potential for high return on investment if property is renovated and resold.

- Opportunity to build a real estate investment portfolio at a lower cost.

Risks Associated with Purchasing Foreclosed Homes and How to Mitigate Them

- Property condition may be poor due to neglect by previous owner.

- Hidden liens or other financial obligations attached to the property.

- Potential for legal complications if eviction of previous owner is required.

It is crucial to conduct a thorough inspection and title search before purchasing a foreclosed property to uncover any issues and mitigate risks.

Strategies for Finding and Evaluating Foreclosure Properties

- Work with a real estate agent experienced in foreclosure properties.

- Attend foreclosure auctions or search online foreclosure listings.

- Consider hiring a home inspector to assess the property’s condition.

Building a Home

Building a home from scratch can be a rewarding experience as it allows you to create a space that is tailored to your specific needs and preferences. From selecting the location to choosing the design and finishes, the process of building a custom home involves careful planning and coordination.

Benefits of Constructing a Custom Home

- Customization: Building a custom home allows you to personalize every aspect of the design, from layout to materials, to fit your lifestyle and taste.

- Quality Control: With a custom home, you have more control over the quality of materials and construction, ensuring a higher level of craftsmanship.

- Energy Efficiency: Custom homes can be designed with energy-efficient features, such as solar panels or high-performance insulation, to reduce utility costs.

- Long-Term Investment: A custom-built home can increase in value over time, providing a good return on investment compared to a pre-existing home.

Key Considerations when Selecting a Builder

- Experience and Reputation: Look for builders with a proven track record of successful projects and positive reviews from previous clients.

- Licensing and Insurance: Ensure that the builder is licensed and insured to protect yourself from liability in case of accidents or construction defects.

- Communication and Transparency: Choose a builder who communicates effectively and is transparent about costs, timelines, and potential challenges throughout the construction process.

- Contract and Warranty: Review the construction contract carefully and make sure it includes a warranty that covers any defects or issues after completion.

Tips for Managing Costs and Timelines

- Set a Realistic Budget: Establish a budget that takes into account all costs, including permits, materials, labor, and unexpected expenses.

- Plan Ahead: Create a detailed construction timeline with milestones and deadlines to track progress and avoid delays.

- Regular Site Visits: Visit the construction site regularly to ensure that the work is being done according to plan and address any issues promptly.

- Flexibility: Be prepared for unexpected changes or delays during the construction process and work closely with your builder to find solutions.

Commercial Construction

Commercial construction refers to the process of building structures that are used for commercial purposes such as offices, retail stores, restaurants, and industrial facilities. This sector plays a crucial role in the real estate industry as it caters to the needs of businesses and contributes to economic growth.

Differences Between Residential and Commercial Construction Projects

- Scale and complexity: Commercial projects are usually larger and more complex than residential ones, requiring specialized skills and resources.

- Zoning and regulations: Commercial construction projects must adhere to specific zoning laws and regulations that differ from those for residential properties.

- Design and functionality: Commercial buildings are designed with a focus on functionality and efficiency to meet the needs of businesses and customers.

Key Factors to Consider when Investing in Commercial Construction Projects

- Location: Choose a strategic location with high demand and growth potential for commercial properties.

- Market analysis: Conduct thorough market research to understand the demand for commercial spaces in the area.

- Budget and financing: Ensure you have a solid budget and financing plan in place to cover the costs of the project.

Tips for Navigating Regulations and Zoning Laws in Commercial Construction

- Consult with legal experts: Seek advice from legal professionals who specialize in real estate and construction laws to ensure compliance.

- Engage with local authorities: Build relationships with local authorities and zoning officials to navigate the permitting process smoothly.

- Stay updated: Stay informed about any changes in regulations or zoning laws that may impact your commercial construction project.

Condominiums

Condominiums, commonly known as condos, are individual units within a larger complex or building that are owned by individual homeowners. Unlike traditional homes, where the homeowner owns the land and the structure, condo owners only own the interior of their unit. The exterior and common areas of the building are owned collectively by all the unit owners.

Benefits of Investing in Condominium Properties

- Lower Maintenance: Condos often have lower maintenance costs as the exterior and common areas are taken care of by the condo association.

- Affordability: Condos can be a more affordable option for first-time investors compared to buying a single-family home.

- Amenities: Many condo complexes offer amenities such as pools, gyms, and community spaces that can attract tenants and increase property value.

- Location: Condos are often located in desirable urban or beachfront locations, making them attractive to renters.

Key Factors to Consider when Buying a Condominium for Investment Purposes

- Location: Consider the proximity to amenities, public transportation, schools, and job opportunities.

- Condo Association Rules: Review the association rules and regulations to ensure they align with your investment goals.

- Rental Restrictions: Check if there are any rental restrictions in place that could impact your ability to rent out the unit.

- Reserve Funds: Ensure that the condo association has enough reserve funds to cover maintenance and repairs.

Tips for Managing Condo Associations and Fees as an Investor

- Stay Engaged: Attend association meetings and stay informed about any upcoming changes or issues.

- Budget Wisely: Factor in condo fees when calculating your expenses and potential rental income.

- Build Relationships: Establish a good relationship with the condo association members to ensure smooth communication and cooperation.

- Respect the Rules: Adhere to the association rules and regulations to avoid any conflicts or fines.

Green Real Estate

Green real estate refers to properties that are designed, built, and operated using environmentally friendly practices. This type of real estate aims to reduce the negative impact on the environment while promoting sustainable development. Investing in green real estate has become increasingly popular due to the growing awareness of climate change and the importance of conserving natural resources.

Benefits of Investing in Green Real Estate

- Lower utility costs: Green properties are designed to be energy-efficient, resulting in lower electricity and water bills for the owners.

- Higher resale value: Green features in homes attract buyers who are willing to pay more for environmentally friendly properties, increasing the resale value.

- Healthier living environment: Green buildings often use non-toxic materials and improve indoor air quality, creating a healthier living space for occupants.

Popular Green Features in Homes

- Solar panels: Harnessing solar energy to power homes and reduce reliance on traditional electricity sources.

- Energy-efficient appliances: Using appliances with high energy efficiency ratings to reduce electricity consumption.

- Water-saving fixtures: Installing low-flow toilets, faucets, and showerheads to conserve water resources.

Tips for Incorporating Eco-Friendly Practices

- Work with green builders and architects who specialize in sustainable design and construction.

- Consider retrofitting existing properties with green features to improve energy efficiency and sustainability.

- Educate yourself on green building certifications and standards to make informed decisions about eco-friendly investments.

Home Staging

Home staging is the process of preparing a property for sale by enhancing its appeal to potential buyers. This involves decluttering, cleaning, rearranging furniture, and adding decorative touches to showcase the property in its best light.

Benefits of Home Staging

- Increases the perceived value of the property

- Makes the space more attractive and inviting

- Helps buyers visualize themselves living in the home

- Can lead to a quicker sale and potentially higher offers

Key Tips for Effective Home Staging

- Start by decluttering and cleaning the space thoroughly

- Depersonalize the decor to appeal to a wider range of buyers

- Focus on highlighting the best features of the property

- Consider hiring a professional stager for expert advice

Budget-Friendly Staging Techniques

- Rearrange existing furniture to create better flow and showcase space

- Add fresh flowers or plants for a pop of color and freshness

- Use neutral paint colors to create a clean and inviting atmosphere

- Add mirrors to make rooms appear larger and brighter

In conclusion, the journey of exploring foreclosure buying tips for first-time investors culminates in a comprehensive understanding of the strategies, risks, and advantages associated with this type of investment. Armed with these insights, investors are better positioned to embark on their real estate ventures with confidence and clarity.

Common Queries

What are the key advantages of buying foreclosed properties for first-time investors?

Foreclosed properties often come at discounted prices, providing an opportunity for first-time investors to enter the market at a lower cost.

How can first-time investors mitigate the risks associated with purchasing foreclosed homes?

Conducting thorough research, getting a professional inspection, and having a clear budget in place can help mitigate risks when buying foreclosed properties.