Delving into How to finance a condominium purchase with a mortgage, this guide offers valuable insights and practical tips to navigate the complex world of real estate financing. From understanding different financing options to maximizing your investment, this overview sets the stage for a deep dive into the nuances of buying a condo with a mortgage.

Exploring topics ranging from building a home to navigating foreclosures, this guide equips readers with the knowledge needed to make informed decisions when it comes to financing a condominium purchase.

Building a Home

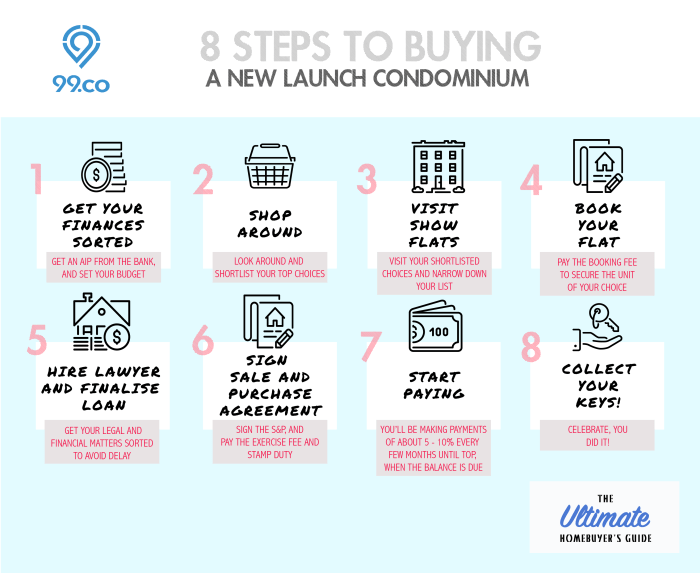

When it comes to financing a condominium purchase with a mortgage for a newly constructed home, there are specific steps involved to ensure a successful transaction. Understanding the process can help you navigate the complexities of obtaining financing for a condominium project.

Comparing Financing Options

When considering financing options for building a condominium versus buying an existing one, there are some key differences to take into account. Building a condominium from scratch may require a construction loan, which can have different terms and conditions compared to a traditional mortgage for an existing property.

Tips for Obtaining a Construction Loan

Securing a construction loan to finance a condominium project can be a bit more challenging than obtaining a standard mortgage. Here are some tips to help you navigate the process:

- Prepare a detailed construction plan outlining the project timeline, budget, and specifications to present to potential lenders.

- Work with experienced professionals, such as architects and contractors, who have a track record of successful condominium projects.

- Ensure you have a solid financial plan in place, including a down payment and reserve funds for unexpected costs during construction.

- Shop around for lenders who specialize in construction loans and have experience working with condominium developments.

- Be prepared for a thorough review of your financial history and creditworthiness, as lenders may have stricter requirements for construction loans.

Commercial Construction

When it comes to financing a commercial condominium project, there are distinct differences compared to residential construction. Commercial projects tend to be larger in scale, involve multiple stakeholders, and have different financial considerations that lenders take into account.

Key Factors Considered by Lenders

- Financial Stability: Lenders look at the financial stability of the borrower and the project itself. They want to ensure that the project has a solid financial plan in place.

- Rental Income: For commercial projects, lenders often consider the potential rental income that the property can generate. This income is crucial for repaying the mortgage.

- Market Trends: Lenders analyze market trends and demand for commercial space in the area where the project is located. This helps them assess the viability of the project.

- Experience: Lenders may also look at the experience of the developer or project team involved in the commercial construction. Experience in similar projects can instill confidence in lenders.

Challenges and Opportunities

- Challenges: Financing a commercial condominium purchase can be more complex than a residential one due to the larger financial commitment involved. Securing funding for a commercial project may require more extensive documentation and planning.

- Opportunities: Commercial projects can offer higher returns on investment compared to residential properties. They can also provide diversification in a real estate portfolio and potential tax benefits.

Condominiums

Investing in a condominium can be a great way to own property without the maintenance and upkeep of a single-family home. When it comes to financing a condominium purchase with a mortgage, there are specific requirements and considerations that differ from financing a traditional house.

Mortgage Requirements for Condominiums

- Condominiums must be in a complex that is approved by the Federal Housing Administration (FHA) or other mortgage insurers.

- Lenders may have stricter requirements for down payments and credit scores for condominium mortgages compared to single-family homes.

- Buyers may need to pay additional fees, such as homeowner association dues, which can affect the overall affordability of the property.

Comparison with Single-Family Homes

- Financing a condominium typically involves additional scrutiny of the homeowner association’s financial health and management.

- Condominium mortgages may come with higher interest rates due to perceived higher risk associated with shared ownership and maintenance responsibilities.

- Single-family homes offer more control over the property and fewer restrictions compared to condominium living.

Pros and Cons of Condominium Financing

- Pros: Condominiums often provide amenities such as pools, gyms, and security that may not be affordable in a single-family home.

- Cons: Restrictions imposed by homeowner associations can limit your freedom to make changes to your property and may involve additional costs.

- Pros: Condominiums are typically more affordable than single-family homes in the same area, making homeownership more accessible.

- Cons: Resale value of condominiums may be impacted by factors such as market conditions and the financial health of the homeowner association.

Foreclosures

When it comes to financing a foreclosed condominium through a mortgage, there are specific considerations and factors to keep in mind. Foreclosed properties can offer unique opportunities for buyers, but it’s crucial to understand the risks and benefits associated with purchasing a foreclosed condominium with a mortgage.

Financing a Foreclosed Condominium

- Foreclosed properties are typically sold at a lower price compared to market value, making them an attractive option for potential buyers.

- When financing a foreclosed condominium with a mortgage, it’s essential to work with a lender who has experience dealing with foreclosed properties.

- Be prepared for a potentially longer and more complex closing process when purchasing a foreclosed condominium.

Risks and Benefits

- Risks: Foreclosed properties may require significant repairs or renovations, adding to the overall cost of the purchase. There may also be unclear titles or liens on the property that could complicate the transaction.

- Benefits: Buying a foreclosed condominium can provide a good investment opportunity and potential for equity growth. The lower purchase price can also result in lower monthly mortgage payments.

Tips for Navigating the Financing Process

- Get pre-approved for a mortgage before starting your search for a foreclosed property to understand your budget and financing options.

- Work with a real estate agent who has experience with foreclosed properties to guide you through the process.

- Conduct a thorough inspection of the foreclosed condominium to identify any potential issues or repairs needed before finalizing the purchase.

Green Real Estate

In today’s real estate market, there is a growing interest in eco-friendly and sustainable properties, including condominiums. These green properties not only benefit the environment but also offer long-term cost savings for homeowners.

Financing Options for Green Condominiums

When it comes to purchasing a green condominium, there are several financing options available to buyers. One common option is to look for lenders that offer specialized loan programs for eco-friendly properties. These programs may provide lower interest rates or additional incentives for buyers looking to invest in sustainable real estate.

- Buyers can also explore energy-efficient mortgages, which offer financial benefits for properties with green features such as solar panels, energy-efficient appliances, and insulation.

- Some lenders may offer green building certification discounts, rewarding buyers who choose properties that meet specific sustainability criteria.

- Government-backed loan programs like FHA, VA, or USDA loans may also offer financing options for green condominium purchases.

Impact of Green Features on Mortgage Approval

The presence of green features in a condominium can positively impact the mortgage approval process. Lenders may view properties with energy-efficient upgrades as lower-risk investments, as they typically have lower operating costs and higher property values.

- Green features can lead to lower utility bills, which can free up more of the homeowner’s budget for mortgage payments.

- Properties with green certifications or high energy efficiency ratings may qualify for larger loan amounts or better loan terms.

- Appraisers may assign a higher value to properties with green features, which can help buyers secure financing for their purchase.

Special Financing Programs for Green Real Estate

In addition to traditional mortgage options, there are special financing programs specifically designed for green real estate purchases. These programs aim to support buyers in acquiring eco-friendly properties and encourage sustainable living practices.

- The PACE (Property Assessed Clean Energy) program allows homeowners to finance energy-efficient upgrades through a special assessment on their property taxes.

- Green banks and credit unions may offer loans with favorable terms for green real estate purchases, promoting environmentally conscious homeownership.

- Some states and local governments provide grants or rebates for energy-efficient improvements, which can help offset the upfront costs of purchasing a green condominium.

Home Staging

Home staging plays a crucial role in the financing process of a condominium purchase with a mortgage. It involves preparing a property in a way that showcases its best features and maximizes its appeal to potential buyers or lenders.

Tips to Increase Condominium Value through Staging

- Enhance curb appeal by maintaining a well-manicured exterior, clean walkways, and fresh landscaping.

- Declutter and depersonalize the interior to help potential buyers envision themselves living in the space.

- Make necessary repairs and upgrades to ensure the property is in top condition.

- Use neutral colors and modern decor to create a welcoming and inviting atmosphere.

- Showcase the functionality of each room by arranging furniture strategically and highlighting key features.

Importance of Presentation in Securing Financing

Presenting a staged condominium effectively can significantly impact the financing terms offered by lenders. A well-staged property gives the impression of a well-maintained and valuable asset, increasing the likelihood of securing a favorable mortgage. Lenders are more inclined to offer better terms for properties that are visually appealing and move-in ready.

In conclusion, financing a condominium purchase with a mortgage requires careful consideration and strategic planning. By leveraging the information provided in this guide, you can confidently embark on your journey towards owning your dream condo. Whether you’re a first-time buyer or a seasoned investor, the key to success lies in understanding the intricacies of real estate financing and making informed choices that align with your financial goals.

Quick FAQs

Can I finance a newly constructed condominium with a mortgage?

Yes, you can finance a newly constructed condo with a mortgage by obtaining a construction loan or traditional mortgage.

What are the key differences between financing a commercial versus residential condominium project?

Commercial projects typically require larger loans and have different approval processes compared to residential ones.

Are there special financing programs for purchasing green real estate?

Yes, there are special financing programs available for eco-friendly or sustainable condominium purchases.

How does home staging impact the financing process of a condominium purchase?

Home staging can increase the perceived value of a condo and potentially lead to better mortgage terms.

What are the risks and benefits of purchasing a foreclosed condominium with a mortgage?

Purchasing a foreclosed condo can offer discounts but also comes with risks such as hidden repair costs.